Accidental death and dismemberment insurance: Why do you need it?

Insurance Insights

March 19, 2018

Contributed by: Kelly Guest | Insurance Advisor, ADIUM Insurance Services Inc.

There is a misconception that AD&D insurance is life insurance – it is not. It is a form of casualty insurance that pays out indemnity benefits when the insured suffers a defined loss or dies as a result of an accident.

AD&D insurance acts as a supplement to term or permanent life and disability insurance coverage. As there is no proof of good health required to enroll in the plan, it is a viable option for those individuals who may not be able to obtain insurance due to health or lifestyle reasons.

There are two components to the plan – coverage for premature death by accident (accidental death) and a physical loss (dismemberment) – up to the anniversary date of the plan following the 75th birthday of the insured. You are insured 24-hours-a-day, anywhere in the world.

If an insured passed away as a result of an accident and not an illness, the full face value of the policy would pay out to the beneficiaries. If the insured had additional life insurance under a separate policy, those proceeds would also be paid – or a double indemnity payment consisting of the life and accidental death benefits would be paid to the beneficiaries designated in the policies.

As with any type of insurance, there are exclusions attached to the coverage. Typical exclusions include suicide or any attempt, and intentionally self-inflicted injuries. Full-time deployable military personnel and crew members on any aircraft are also not eligible for the coverage.

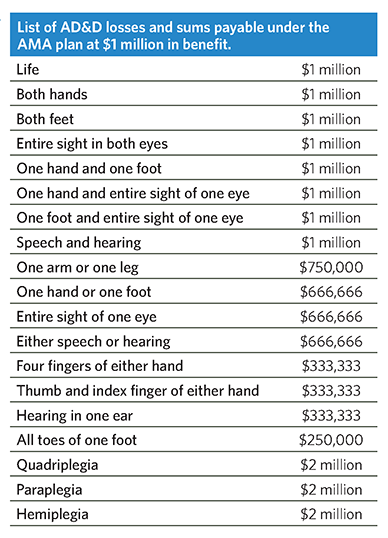

If an insured suffers a permanent physical loss or total loss of use of limbs, hearing, eyesight, or paralysis, as examples, within 12 months after the date of an accident, a portion of the face value of the policy would pay out to the insured. This is the dismemberment element of the plan. Physicians are particularly interested in this benefit due to the protection it provides should they suffer a physical loss which could potentially end their career in medicine such as hand(s) or eyesight.

Several years ago, an AMA member received a dismemberment payout of $2 million after suffering paralysis due to an accident in his home. In addition to the dismemberment benefit, he also received monthly disability payments as the paralysis rendered him totally disabled. Spousal and dependent child benefits are also available under the family AD&D plan. A percentage of the face value would be paid to the primary insured in the event of death – or they as the insureds would be paid a portion of the value of the policy if they suffered a physical loss.

Additional coverage may also be included for rehabilitation, repatriation, family transportation, spousal occupational training, home and vehicle modification, day care costs, bereavement benefit, critical disease and funeral expenses.

Again, AD&D insurance should only be purchased as a supplement to life and disability insurance – but for uninsurable individuals, it may be one of your limited choices.

Example:

$1 million in member AMA AD&D coverage

Member only is $25/month

Member/family is $35/month

For more information on the AMA AD&D plan, visit our Insurance page